If you decide to use Java utility, you should remember a few things. But my recommendation is to use Java utility over excel utility as the former is more sophisticated and will require lesser number of steps. Excel Vs Java utility for Income Tax returns e-filingĮither of excel and Java utility can be used to e-file returns without any restrictions. More Instructions on each form can be obtained from the link provided in the table itself. ITRįor Individuals having Income from Salaries, One house property, Other sources (Interest etc.)įor Individuals and HUFs not having Income from Business or Professionįor Individuals and HUFs not having Income from Business or Profession and Capital Gains and who do not hold foreign assetsįor Individuals/HUFs being partners in firms and not carrying out business or profession under any proprietorshipįor individuals and HUFs having income from a proprietary business or professionĭecide the income tax form suitable for you based on your income categories and as per the table given above.

How to decide the income tax returns e-filing form suitable for you.

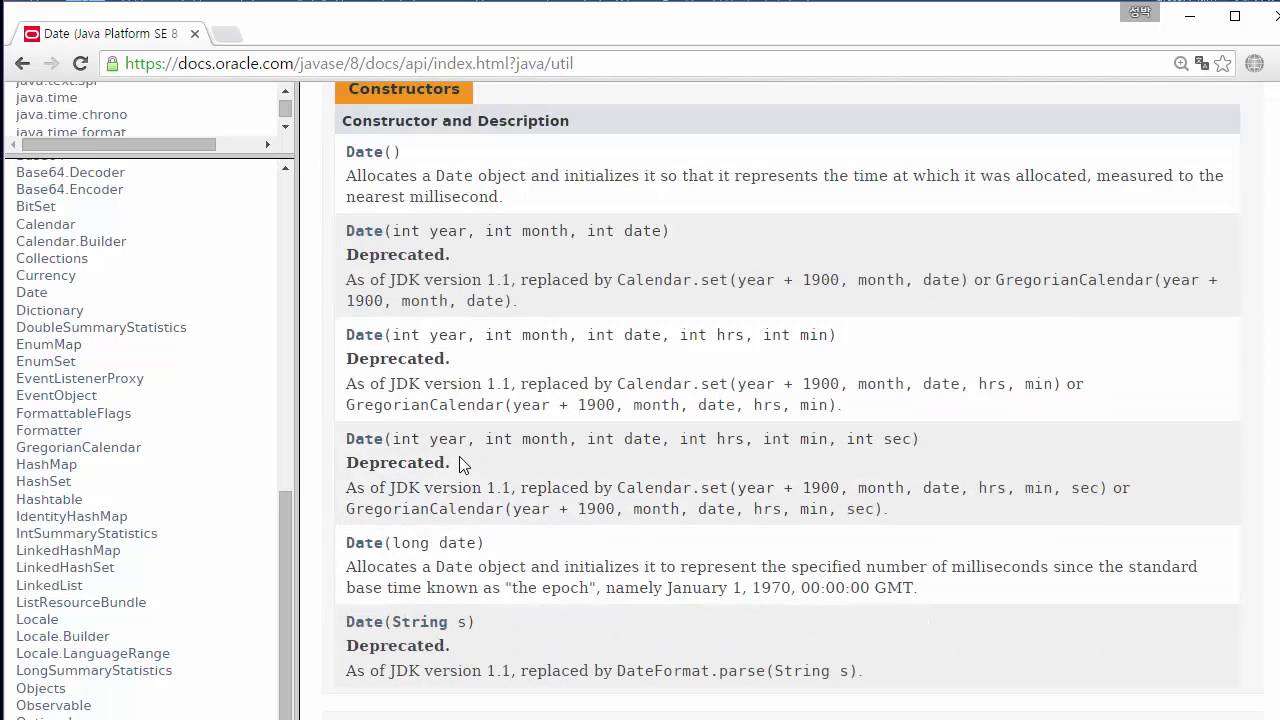

Let us have a detailed look at each of the steps involved. Step by step guide on Income Tax Returns e-filing Quick view of steps involved in Income Tax Return e-filing.

0 kommentar(er)

0 kommentar(er)